Pre-decimal coins, half and quarter rupees were in circulation after decimalization. For a short time, both decimal and non-decimal coins were in circulation. Before the decimalization, one rupee was divided into 16 annas or 64 pice. In April 1957, the Indian rupee was decimalized and was divided into 100 naya paisa ('new' paisa). Foreign borrowings increased in high magnitude in the 1960s. To finance welfare and development activities, especially with the adoption of the five-year plan in 1951, the Indian government under the Prime Minister of Pandit Jawaharlal Nehru, continuously borrowed money from foreign or private sector savings starting from the 1950s onwards. When India became independent in 1947, the Indian economy was in a poor state. This was a relative exchange rate and not a fixed exchange rate.įollowing is the breakdown of how the Rupee performed against the Dollar post-1947. India was also part of this agreement, and hence at the time of independence, India followed the par value system of exchange rates. Since, 1 pound was equal to $2.73 at that time, the value of USD vs INR in 1947 can be calculated as 1 USD = 4.76 Rupee.Īs per the Bretton Woods Agreement of 1944, each country was required to peg the value of its currency to the dollar, which itself was convertible to gold at the rate of $35 per ounce. There was no standard system of comparing the world currencies before 1944, so this valuation remained constant. However, as India was a British ruled state before its independence, the value of INR was derived from the British pound.

#Dollar rupee rate free

Rupee After India's IndependenceĪs a free country in 1947, India had no foreign debt or credit on its balance sheet.

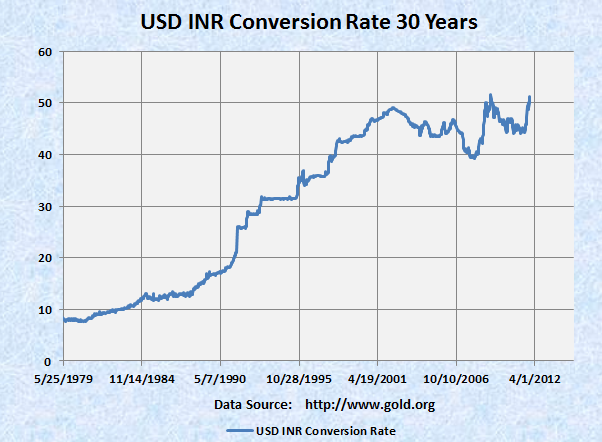

Let's look at the history of the dollar vs rupee since 1947 to understand its journey of depreciation against the dollar. Judging from the value of 72.55 rupees per dollar in the current time, the Indian rupee has been depreciating against the USD in the past 71 years. Geopolitical issues, economic reforms, and international issues have affected its value over the years. Since independence, the Indian currency has been on a roller-coaster journey. If it takes more Indian currency to buy 1 USD, it means that the Indian currency has depreciated and if it takes less, the currency has appreciated. If the value of foreign currency increases, imports get expensive and exports get cheaper.

The whole global trade is possible because of its existence. The exchange rate constantly changes in the global foreign exchange market and is an important determinant of a nation's economic power.

The value of 1 USD to INR keeps fluctuating and it is called the exchange rate. The strength of India's currency, the Rupee (INR) is also weighted against the USD. Till today, countries peg their currencies against the USD to determine their value in the global market. More than 60% of global foreign reserves are in USD, making it the most commonly held reserve currency in the world. It has dominated the financial market and has become the de-facto currency for international trade and transactions. dollar (USD) has been the most powerful currency in the world. The rupee on Wednesday touched record lows even as the Reserve Bank of India (RBI) sold dollars to limit losses.Post-World War II, the U.S. "The Indian Rupee has been adversely affected mainly by the FIIs pulling out funds from the equity market, rising crude prices, the deteriorating trade balance and dollar strengthening," analysts at Emkay Wealth Management said in a note.įoreign institutional investors have sold local shares worth $28.4 billion so far in 2022 and dumped bonds worth $2.3 billion. "The Indian rupee has continued to move on the downhill journey since the beginning of the year, amid a backdrop of heavy foreign fund outflows from the domestic markets, strength in the safe-haven dollar towards two-decade highs, and firming crude oil prices," said Sugandha Sachdeva, Vice President - Commodity and Currency Research, Religare Broking Ltd. The backdrop of heated inflation, prolonged covid-19 lockdowns in China, the monetary tightening campaign of the key central banks, and supply chain disruptions caused by the Russia-Ukraine war have been clouding the outlook for global economic activity and have led to steep depreciation of the rupee against the dollar by over six per cent so far this year.

0 kommentar(er)

0 kommentar(er)